$ Login & Signup

19. september 2024255% bonus up to 450 & 250 Free Spins

24. oktober 2024In investing, a suspense account is a sort of brokerage account the place a customer’s proceeds from promoting an investment may be recorded until the client uses the money to put money into one thing else. A suspense account must be used when there are unclear transaction particulars, unclassified receipts, or discrepancies that require further investigation to classify correctly beneath particular accounts. It ensures that these entries don’t intrude with other https://www.quickbooks-payroll.org/ accounts or the preparation of financial statements whereas the difficulty is being addressed. Simply put, a suspense account is a brief lived place to park transactions till their final destination in your books is obvious.

Credit Score Cloud

As Soon As you identify the customer or invoice, the transaction is moved to the proper account. Today, on-line accounting and invoicing software like Debitoor gives you the instruments to simply manage your revenue and expenses, from anyplace. When it involves your transactions, computerized financial institution reconciliation can help you match your payments in an instant. Suspense accounts and clearing accounts are each used to record transactions on a brief foundation, at least till these transactions have been assigned to their respective place in the general ledger. Nevertheless, in the case of suspense account, there is usually an added concern which will need resolution.

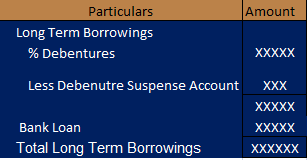

The journal entries are made solely when all errors are detected and rectified. These entries eliminate the influence of errors in accounting information and shut the suspense account. A suspense account is an account in the basic ledger in which Suspense Account In Accounting quantities are quickly recorded. A suspense account is used when the right account can’t be decided on the time the transaction is recorded. When the right account is determined, the amount might be moved from the suspense account to the proper account. It can additionally be used when there’s a difference between the debit and credit score side of a closing or trial stability, as a holding area till the reason for error is situated and corrected.

Sometimes, accounting teams don’t have all the required information for a particular transaction. Regardless of that, they should record each transaction to maintain their ledger books up to date, and this is where the suspense account comes in handy, as they don’t seem to be positive the place to report common ledger entries. When you obtain the total cost from the customer, debit $50 to the suspense account. This closes the suspense account and strikes the cost to the right account. Finally, you allocate entries within the suspense account to a permanent account. The account quickly holds entries when you determine how you will classify them.

Financial Consolidation & Reporting

A suspense account is a vital software within the accounting process, designed to deal with transactions with uncertainties or discrepancies. By temporarily holding these transactions, suspense accounts be certain that all monetary activities are recorded precisely and transparently. Proper management and regular evaluate of suspense accounts are crucial for sustaining correct monetary information and facilitating easy audits. Suspense Accounts are momentary accounts used to record transactions that cannot be instantly categorized or recognized. They play a critical position in sustaining the integrity of the accounting system, ensuring that the trial stability stays balanced even when discrepancies or incomplete data come up.

Suspense Account Which Means In Real Property: Mortgage Suspense Account

A brokerage suspense account performs an important role on the earth of investing, just like different forms of suspense accounts, however it’s specifically used inside brokerage corporations. This kind of account quickly holds funds or securities until the proper placement of the transactions can be determined. A trial stability is the closing stability of an account that we calculate on the finish of the accounting period. When the two sides of the trial steadiness don’t match, we hold the difference in a suspense account till we appropriate it. If the debits in the trial steadiness are bigger than credit, we record the difference as a credit score.

Use a suspense account when you’re undecided where to record common ledger entries. It’s essential to keep unidentified amounts in a separate account in order to keep organised and determine them later extra easily. These unmatched amounts shouldn’t be left in amongst your already-identified transactions. The suspense account provides them a temporary place until they can be correctly placed.

- Auditors can hint the origins of transactions recorded in suspense accounts during an audit and confirm their accuracy.

- Financial reporting is sensitive and might, at instances, be the difference between getting that initial funding or failing to get funding.

- Suspense accounts play a vital role in sustaining accurate monetary records when transactions aren’t instantly clear.

- When the controller is out there, the accountant will get clarification and will transfer the quantity from the Suspense account to the suitable account.

- Double Entry Bookkeeping is here to offer you free on-line information that will assist you learn and perceive bookkeeping and introductory accounting.

Till they withdraw, the remittance stays in a suspense account, earning the monetary institute or the BB enabler float/interest on that money. When customer withdrawal is completed, the cash strikes from the suspense account to the account of the agent who facilitated the cash withdrawal. While suspense accounts are invaluable tools in accounting for managing transactions that can not be instantly categorized, additionally they come with their own set of challenges. Here are a variety of the key difficulties that may arise when using suspense accounts and recommendations on the means to address them. Suspense accounts are invaluable instruments for sustaining readability and accuracy in monetary reporting.

Collectively, these advanced instruments from HighRadiu streamline the reconciliation process, enhancing compliance with worldwide accounting requirements. By transforming reconciliation from a posh problem right into a streamlined operation, HighRadius empowers businesses to maintain up correct data effortlessly and concentrate on strategic financial management. A mortgage suspense account is a particular kind of suspense account used on the planet of home loans and mortgages. It is used exclusively for mortgage funds that can not be totally applied to a mortgage account immediately. When you get the knowledge you need, reverse the suspense account entry and make an entry in the permanent account. This closes out the suspense account and posts the transaction to the right account.

This is because unallocated transactions get tougher to reconcile with passing time, especially if there might be inadequate documentation, and the account balance could grow uncontrollably. The bookkeeper is unable to steadiness the company’s trial stability, with the credit score column exceeding the debit facet by $500. A customer paid $1,000 in cash without specifying which bill the payment relates to.

Each suspense accounts and clearing accounts are used to briefly record transactions until they are often permanently assigned. Suspense accounts, nonetheless, are more usually used when there’s some query concerning the transaction that must be resolved. Sure, a suspense account can have both a debit or a credit score stability, relying on the character of the transactions recorded inside it. If it is an asset, the suspense account can be a present asset because it holds funds which would possibly be related to accounts receivables.